You want to apply for a credit card online, but don't know exactly how? We explain step by step how you can easily and conveniently apply for a credit card online. Whether you need a credit card for everyday use or for your travels, the process is simple and time-saving online.

The most important facts in a nutshell

- Compare credit card offers online

- Pay attention to annual fees, additional services, interest rates and acceptance

- Select the credit card you want and start the online application process

- Complete the online application form in a few minutes

- After a positive identity and credit check, you will receive your credit card by post.

Content

- Research and comparison of credit cards online

- The online application

- Fill in the application form

- Credit assessment and credit decision

- Legitimation check and proof of identity

- Which credit cards work without a current account?

- What to do if my credit card application is declined?

- Recommended credit cards online

- Conclusion

Research and comparison of credit cards online

The first step in applying for a credit card online is to find and compare different offers. There are many providers offering different credit cards with various features and benefits. This step takes the most time because there are many credit cards. To save you time, we have compiled a credit card comparison with the most popular credit cards. In order to find the right map for you from the nearer selection, pay particular attention to the following points:

- Annual fee: Check whether the credit card has an annual fee and whether the fee is worth it for the services offered.

- Additional services: Some credit cards offer attractive additional services such as travel insurance, cashback programmes or bonus points. Depending on your needs, decide which additional services make the most sense for you.

- Fees for foreign assignments: If you plan to use the credit card frequently when travelling, be aware of any foreign transaction fees.

- Debit interest: Find out about the amount of the debit interest if you also want to use the credit card for instalments.

- Acceptance: Find out whether the credit card is accepted both at home and abroad. Especially with American Express cards, there can be significant restrictions in acceptance depending on the country. You can read more about this in our article on travel credit cards. Alternatively, you can recognise the acceptance points locally by the Mastercard, Visa or American Express logo on the ATMs and the shop's card machines.

You should also make sure which type of credit card is right for you. These differ from each other as follows:

- Debit credit card: Debit cards are not real credit cards. They automatically charge all transactions to your current account. There is therefore no separate credit line and the debit is either immediate or within a few days. Your current account must show the amount paid.

- Prepaid credit card: Prepaid cards are also not real credit cards, because you have to load money onto the card account and can only spend this amount. You are therefore not granted credit. These cards are ideal for minors and people whose credit rating is considered less good by Schufa and banks. However, if you do not belong to these groups of people, you should consider other cards, as prepaid credit cards often have a complex cost structure and can be very expensive. They are also not accepted by every hotel or car rental company.

- Charge credit card: The way charge credit cards work is that the bank collects the amounts you spend with the card and debits them from your current account once a month. So you get a credit from the bank for a short time. However, you have to repay this credit in time before it is debited to avoid overdrawing your current account.

- Revolving credit card: These cards are comparable to an instalment or framework loan: you have the option of repaying the money you have spent in instalments, with high interest charges. It is advisable to pay your debts in full on time and to rather do without this option in order to avoid high interest costs. However, revolving credit cards often offer very good additional services and, apart from the interest, very low or no fees.

The online application

After you have found the right credit card, click on the button "To Provider". This will take you to the online application form.

Fill in the application form

The application form is the most important part of the online application process. Here you have to fill in your personal data, contact information and financial situation. It is important that you enter the data carefully, as incorrect information can delay the response or get you rejected. The exact information required can vary depending on the provider, but the following data is usually requested:

- Personal data: Name, date of birth, address, nationality

- Contact information: E-mail address, telephone number

- Financial information: Information about your financial situation or existing credit

Credit assessment and credit decision

After you have filled out the application form, the credit card provider will carry out a credit check. This checks your creditworthiness and ability to pay. The provider usually uses information from the credit agency Schufa. Depending on the results of the check, the provider will make a credit decision. If your creditworthiness is sufficient, you will usually receive a positive answer immediately or within a few days.

Legitimation check and proof of identity

To confirm your identity and prevent fraud, the credit card provider will carry out a legitimation check in the next step. This can be done either online or offline. With online verification, you will be asked to confirm your identity via a video call or by using electronic proof of identity. Offline verification may require you to send a copy of your ID or other documents. In most cases, you can assume that the proof of identity will be verified online.

Which credit cards work without a current account?

Some banks, such as DKB, Comdirect or Consorsbank, offer the credit card together with the current account. If the account is free or you want to use it as your main account, this is a good option.

However, if the current account incurs costs or you only want a separate credit card, there are other options. Many providers offer credit cards individually. In this case, you need a reference account through which you pay the credit card bill. Recommended examples are the cards of Advanzia Bank and Novum Bank.

What to do if my credit card application is declined?

In most cases, banks require that customers are of age and financially stable in order to receive a credit card in the first place. They refer to this financial stability as a "good credit rating". If your credit rating is not considered "good", the credit card application can be rejected. However, there are exceptions, especially with debit or prepaid cards. This is because these can also be issued to minors or people with a bad credit rating. In such cases, the Schufa query is often omitted from the application.

However, it is also possible that there are incorrect entries in the Schufa, which in turn could lead to the customer being rejected by the bank. If you have difficulties applying for a credit card, we recommend that you check your Schufa record and have any errors corrected. Then you can apply for your credit card online again.

Recommended credit cards online

Here are some recommended credit cards that you can easily apply for online:

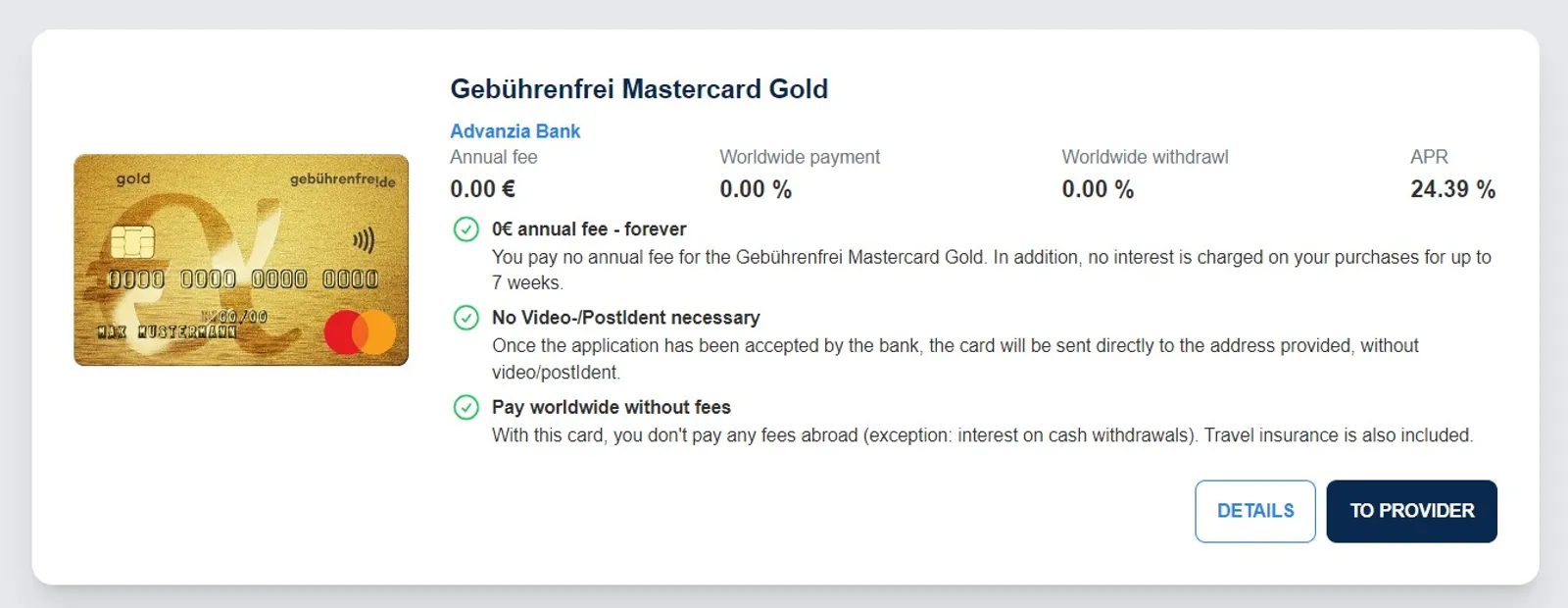

Advanzia Bank

- 0€ annual fee - foreverYou pay no annual fee for the Gebührenfrei Mastercard Gold. In addition, no interest is charged on your purchases for up to 7 weeks.

- No Video-Ident necessaryOnce the application has been accepted by the bank, the card will be sent directly to the address provided, without video/postIdent.

- Pay worldwide without feesWith this card, you don't pay any fees abroad (exception: interest on cash withdrawals). Travel insurance is also included.

Novum Bank

- 0€ annual fee - foreverYou pay no annual fee or card fee for the extra card permanently.

- Immediate decision on your applicationApply in the morning, shop at noon. Your application will be checked immediately and, if accepted, you will receive your extra card in advance as a virtual credit card. The physical card will then be sent to you by post.

- Free use in the euro areaWith this card you pay no fees in any country where the currency is the euro (exception: interest on cash withdrawals).

Trade Republic

- Bank account with interestActivate interest and get interest for your balance.

- No annual feeThe bank account has no annual fee. No hidden fees on non-euro payments.

- Up to 1% savebackGet 1% back on eligible card payments as an investment into your saving plan.

Bank Norwegian

- 0€ annual fee - foreverYou pay no annual fee for the Bank Norwegian credit card.

- Free of charge international usageWith this card, you don't pay any fees abroad (exception: interest on cash withdrawals). Travel insurance is also included.

- Contactless paymentConnect your credit card to Google Pay or Apple Pay and use the contactless payment option.

Consors Finanz

- Permanently 0€ annual feePermanently without an annual fee for 100% freedom to shop anywhere, anytime

- More cash with one clickProtect yourself from unplanned spending: transfer the desired amount to your current account at any time via CashClick

- Interest-free repayment up to 90 days laterYou can repay your purchases conveniently within 90 days interest-free

- Pay with your smartphoneMobile payment with Apple Pay and Google Pay

Hanseatic Bank

- 0€ Annual feeThe awa7 VISA has no annual fee and no minimum purchase.

- Card made from 85% rPVCThe awa7 VISA is a card made from 85% recycled PVC.

- Flexible installment paymentYou decide for yourself how you repay your transactions. The awa7 VISA offers you a flexible installment facility. You can change the rate at any time in the app.

Instabank

- 0€ Annual feeThe Instabank VISA has no annual fee and no minimum purchase.

- Ready to use immediatelyThe virtual card and credit limit are available immediately after successful application. The plastic card will be sent by post.

- Flexible installment paymentYou decide how you repay your transactions. The minimum amount you must pay for the credit card bill is 2.5% of the bill amount, but at least 30 euros.

Hanseatic Bank

- Generous card limit of up to 3,500 €The GoldCard offers you a generous card limit for your travel, purchases and other wishes. If you wish, you can transfer part of the card limit to your current account.

- Withdraw money worldwide free of chargeWith the GoldCard from Hanseatic Bank, you can withdraw cash at ATMs worldwide free of charge

- Flexible repaymentYou decide for yourself how you repay your sales. Your GoldCard offers you a flexible installment facility. You can change the repayment amount yourself at any time.

- Pay with your smartphoneMobile payment with Apple Pay and Google Pay

Barclays Bank

- Free of charge worldwideWith the Barclaycard Visa, using your card at home and abroad is always free of charge. You save both the foreign currency fees that are often incurred and the cash withdrawal fees.

- Pay more securely than ever beforeBarclays offers a 24-hour emergency hotline, card fraud protection, up to €500 in emergency cash and online payment security.

- Flexible repayment of expensesFlexible repayment of expenses with a payment term of up to 8 weeks

American Express

Bonus: 144 €

- Collect Membership RewardsWith the Amex Gold Card, you always collect bonus points wherever you go, which you can redeem for rewards and vouchers.

- Comprehensive insurance packageThe Amex Gold Card offers you a comprehensive insurance package. The travel cancellation insurance in particular is really recommendable.

- Profit from Amex OffersWith Amex Offers, you benefit from discounts and credits or receive additional points with numerous acceptance partners. Simply view and activate them via the Amex app or in your online card account.

American Express

Bonus: 200 €

- Various annual bonusesWith the Amex Platinum Card you will receive €200 travel credit, €150 restaurant credit and many more rewards every year.

- Platinum LifestyleSomething special from sport, fashion, entertainment, music, cuisine and art: with your Platinum Card you have the best seats everywhere and benefit from numerous advantages worldwide

- Exclusive premium servicesThe Amex Platinum Card includes top premium benefits such as free status upgrades, comprehensive insurance and many other advantages.

American Express

Bonus: 25 €

- Foerver €0 annual feeThe Amex Blue is permanently without annual fee.

- Maximum transparencySee all your spending in your Amex bannking app and keep track of all your expenses and all of your income in a single place.

- Amex OffersWith Amex Offers, you benefit from discounts and credits or receive additional points with numerous acceptance partners. Simply view and activate them via the Amex app or in your online card account.

Conclusion

Applying for credit cards online is easy and convenient. By comparing different credit cards, you can quickly find the right card. Complete the application form in a few minutes and confirm your identity. After the subsequent positive credit check, you will receive your credit card in a few days and can enjoy all the benefits!